An ATM, which stands for automated teller machine, is a specialized computer that makes it convenient to manage a bank account holder’s funds. It allows a person to check account balances, withdraw or deposit money, print a statement of account activities or transactions, and even purchase stamps.

How To Use MCB ATM Machine In Mauritius?

Our network of ATMs adds up to the largest on the island – more than 160 across Mauritius and Rodrigues, and it keeps on growing. We were the first bank to offer this form of self-service banking in 1987 and we haven’t looked back since. MCB ATM is your convenient solution for your banking on the go. Get cash, check balances, get mini-statements, and much more.

Apart from withdrawing cash, ATMs have begun to offer a plethora of useful services like –

A. Open or withdraw a fixed deposit;

B. Apply for loans;

C. Pay insurance premium;

D. Pay utility bills;

E. Deposit checks and cash, etc.

Apart from these services, depending on the location and bank, each ATM offers a combination of various services apart from the basic withdrawal of cash.

While an ATM has become a familiar term, the usage of this machine is still a confusing task for many, especially in rural areas, where financial inclusion is still a new concept.

In this article, we have explained the basics of an ATM, followed by the simple procedure of how to withdraw money from an ATM so that one can be well aware of the withdrawal process.

Types of ATMs:

All ATMs are mainly of two types – on-site and off-site.

On-site ATMs are those which are available inside a bank’s compound, whereas an off-site ATM is located in other places, without the presence of a bank branch.

Other than this, ATMs are differentiated on the basis of their origin and purpose. These include –

1. White Label ATMs:

These are set up and operated by Non-Banking Financial Companies (NBFCs) and offer the most popular ATM services.

2. Yellow Label ATMs:

These ATMs are provided to assist people with e-commerce transactions.

3. Brown Label ATMs:

These ATMs are not directly owned by a financial institution but are leased to provide ATM facilities in various places.

4. Orange Label ATMs:

These ATMs are used for all transactions related to the trading of shares.

5. Pink Label ATMs:

These ATMs are made for use by women only.

6. Green Label ATMs:

These ATMs facilitate all transactions related to agriculture.

7. White Label ATMs:

These are set up and operated by Non-Banking Financial Companies (NBFCs) and offer the most popular ATM services.

8. Yellow Label ATMs:

These ATMs are provided to assist people with e-commerce transactions.

9. Brown Label ATMs:

These ATMs are not directly owned by a financial institution but are leased to provide ATM facilities in various places.

10. Orange Label ATMs:

These ATMs are used for all transactions related to the trading of shares.

11. Pink Label ATMs:

These ATMs are made for use by women only.

12. Green Label ATMs:

These ATMs facilitate all transactions related to agriculture.

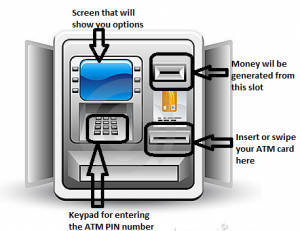

What is the structure of an ATM Machine?

The following parts make up the basic structure of an ATM machine –

A. Display screen – This screen guides the transaction of the user by visually showing them the functions of the machine, and helping them perform the task they need to.

B. Card Reader – This is an input device that identifies your bank account on the basis of the card you feed into the reader.

C. Cash Dispenser – This is the output device from where you can acquire the cash you have withdrawn through the machine.

D. Receipt Printer – This is the point from where you will get the receipt of your transaction, after it is complete.

E. Keypad – This is an input device that guides you through your transaction. Whatever you input through the keypad, will be reflected on the display screen.

How to withdraw money from an ATM?

Let us now look at the steps to withdraw money from an ATM.

Step 1: Insert ATM Card:

Insert your ATM Card in the ATM machine in the slot as marked in the above diagram.

Step 2: Select Language

Select your language from the language options appearing on the display screen (shown in the diagram above).

Step 3: Enter 4-Digit ATM Pin:

Use the Keypad(as marked in the diagram) to enter your 4 digit ATM Pin Number.

Do not ever share your ATM Pin with anyone. Ensure that nobody is watching you, while you enter the Pin.

Be careful while entering the Pin, as a wrong PIN may lead to the blockage of the ATM card.

Step 4: Select the type of Transaction:

On the ATM screen, you will be able to see different types of transaction options such as Deposit, Transfer, Withdrawal of Money, etc.

For cash withdrawal, you will have to select the Withdrawal Option.

Step 5: Select the Type of Account:

After selecting the cash withdrawal option, the screen will display different account types, select your account type.

As an individual banker, you should be choosing a savings account, as current accounts are a special type of accounts used by businesses.

Some ATMs offer you a choice to add a line of credit to your account. This can help a banker when they need excessive money in an emergency.

Step 6: Enter the withdrawal amount

Now, enter your withdrawal amount.

Make sure that you do not enter a withdrawal amount more than the balance in your account.

Now press enter.

Learn the basics of banking in detail with Banking Awareness book for Beginners by Market Experts

Step 7: Collect the Cash:

Now collect the cash from the lower slot of the machine (as shown in the picture above).

Step 8: Take a printed receipt , if needed:

After you collect the cash, you will get an option of whatever you want a printed receipt of the transaction. If you want a printed receipt, click yes and close the transaction.

Step 9: Another Transaction:

If you want to undertake another transaction then select that option.

Withdrawals from an ATM card debit amount from any existing bank account (either savings or current), so when you wish to withdraw, ensure that you have sufficient balance in the account.

ATM Safety Tips

Using an ATM is a simple process — insert your card, punch in your PIN and withdraw your money. However, this simple task can open you and your finances up to certain dangers if you’re not careful.

Although ATM robberies are rare, criminals have invented some creative ways to steal your money and even your identity in these settings. What may seem like a simple second-nature activity can leave you vulnerable to theft in an instant. Fortunately, you and your bank can both take several effective safety measures before, during and after an ATM deposit or withdrawal to ensure your money remains in your hands — and not someone else’s.

Protecting Your Debit/ATM Card

While it’s essential to practice safety tips while using an ATM, there are ways to keep your debit/ATM card safe while at home or on the go. Some ATM safety precautions to practice include:

Store your card in a safe place: Keep your debit/ATM card in a safe place similar to where you would keep cash, credit cards and checks.

Do not leave your card out in the open: Do not leave your debit/ATM card in open spaces where others can have access to it.

Report theft or misplacement as soon as possible: Immediately notify the bank if you lose or card or someone steals it from you.

Do not give out your personal identification number (PIN): Keep your PIN to access your account at the ATM a secret. Never write this number down, especially on your debit/ATM card.

Avoid telephone scams: Never give information about your debit/ATM card over the telephone. If you receive a call from your bank asking you to verify your account, this is a scam, and you should notify the police immediately.

Check your receipts: After withdrawing money from the ATM, compare your receipts with your monthly statement to protect yourself against ATM fraud.

ATM Safety Features You Need to Know

Financial institutions have several safety features already enacted to secure your money — and your personal information. Make sure the ATMs you use have several safety features in place before trusting them with your transactions:

Surveillance cameras: It’s standard for ATMs to have built-in security cameras. Banks and police can then see who is using the machine and what they are doing with it.

Chip security: Today, most bank cards employ chip security as an extra layer of card protection. This feature makes it harder for thieves to successfully skim a card.

PIN pad covers: Many ATMs feature PIN pad covers. Although not completely effective, they reduce external visibility around a PIN pad when in use.

Alarms: Most banks and other institutions equip their ATMs with alarm systems triggered by moving, shoving or tampering with the machine.

Your bank’s help number: If you run into problems at an ATM or think your information is at risk, you can call your bank’s help number for access to immediate help.

Environmental Safety Factors

Before heading to your local ATM, consider the physical area around the machine. Several environmental factors can make a difference in your and your information’s safety, so these tips are essential to keep in mind before you proceed with a transaction:

Use an ATM during daylight hours: If possible, always use an ATM when it’s light out. Robberies are far more likely to happen at night when fewer people surround the ATM’s location and visibility is poor. If you have to use an ATM at night, choose a machine in a well-lit public area, preferably indoors.

Avoid isolated or obscured ATMs: ATM robberies are more likely to happen in remote areas covered by shadows or other structures. Avoid using machines in these environments since bystanders will be less likely to catch any criminal activity.

Avoid ATMs in unfamiliar or suspicious locations: Since using an ATM is a vulnerable activity, avoid ones in locationsthat make you feel uncomfortable or where you sense someone watching your actions. Preferably, stick with a machine you’re already familiar with.

Make sure all the lights on the machine are working: If you see an ATM with any lights out or other visibly broken features, find another machine. Well-lit ATMs are less-frequent targets for criminal activity, and they’re more likely to function properly. Non-working lights may also indicate that someone has tampered with the machine.

Staying Safe While Approaching the ATM

Whether you are driving up to an ATM or approaching it on foot, observe the surrounding area to ensure you’ll be safe throughout the entire transaction. Keep yourself safe as you approach an ATM by:

Observe the area: When approaching the ATM, scan the area for anything suspicious. Dangerous behavior can include two or more people in a nearby vehicle who appear to be watching the ATM or someone who seems to be standing around the ATM for no obvious reason.

Avoid ATMs with bushes: If bushes are blocking the ATM or preventing others from clearly viewing it, do not use the machine, especially after dark.

Choose the ATM in the center of the building: Choosing an ATM on the corner will create a blind area during your transaction. If possible, always select an ATM in the center of the building to prevent any surprises from assailants.

Safety While Using and Leaving an ATM

Once you decide a location is safe and an ATM is ready to use, you should still keep several general safety tips in mind as you complete your transaction and leave the area:

Have your card ready: Have your ATM card in your hand or pocket when you approach the machine so that you don’t waste time rummaging through your bag or wallet. Don’t give thieves time to act. If you’re making a deposit, endorse all checks and secure all cash properly in a deposit envelope beforehand.

Scan the machine for suspicious devices or blocked security cameras: Nearly all ATMs have a security camera built into the system, and a major tactic that thieves use to steal your information at ATMs is obscuring security cameras and installing pin-grabbing cameras. You should always quickly scan the ATM before you use it. If you notice anything suspicious or out of place, leave the area and alert the institution.

Check for card skimmers: A card skimmer is a device hackers will attach to the card reader of an ATM to steal the information from your card after inserting it into the machine. If you notice the card reader is not tightly secured, the slot is a different color than your bank’s branded colors, the keyboard feels too thick, or you cannot easily press the buttons, these are signs a skimmer is in place.

Cover the PIN pad when entering your PIN: Even if no one is standing directly behind you, you should still cover the PIN pad when entering your information. Thieves can install tiny pin-grabbing cameras on the machine that capture your PIN as you enter it. Even an ATM PIN cover doesn’t block all visibility.

Leave your car locked: Always lock your car before approaching an ATM. If you’re in a drive-thru, lock your car doors and roll up all windows besides the one you’re using.

Put the money away immediately: Don’t give anyone an opportunity to grab your cash after you take it out of the ATM. Put it away promptly and count it later.

Always take your receipt: Remember always to grab your receipt after using an ATM. It may contain information that could enable criminals to steal your account or even your identity.

Go straight to your car and drive off: Once you receive your cash and receipt, get in your car immediately and leave the location.

How much can I withdraw from MCB ATM?

The daily limit for Prepaid cards is Rs 10,000 for withdrawals made locally and Rs 20,000 or the equivalent in foreign currencies for overseas withdrawals.